What is a moat?

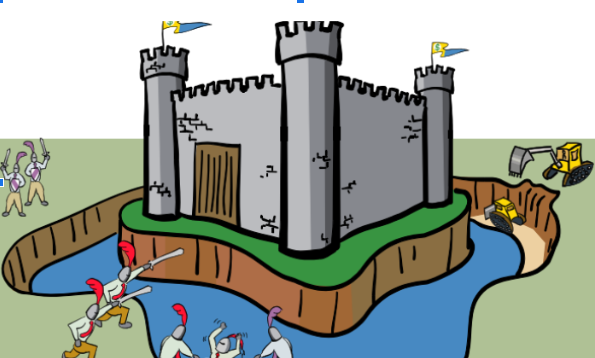

In olden days, to protect a castle, the castle was surrounded by a trench. The trench is generally filled with water and it contains dangerous animals like crocodiles. The castle walls are large so that enemies cannot break-in the castle. Over time, the trench became smaller and enemies managed to break-in the castle. This process took a lot of time and many retries. Mahmud of Ghazni trying to enter into India is a typical example. He tried 17 times for over 12 years.

The castle can be compared to that of a company. The enemies are competitors who want to venture into the market and the trench is the entry barrier for the company to enter into business. Eventually when the competitors enter into the market, the monopoly of the company is lost as a result.

Government Monopolies/ Government-controlled monopolies

There are many government-controlled/regulation-controlled companies. Now this is a monopoly. These Monopolies are at the mercy of government policies/political parties in power. These companies do not work for the interest of the shareholders. They work for the welfare of the Indian government or the welfare of the Public. The government directly controls these companies. The government in most cases does not bother about the welfare of the company, it has personal gains. The government is always in need of money. All the profits of these companies are given as dividends. No money is left over for the growth of the company or investment in the infrastructure of the business/technology advances.

| Company | Market Leader |

|---|---|

| Coal India | Holding an 82% share in coal production |

| Indian Energy Exchange | Holding 95% of short-term electricity contracts in India, IEX is a leader in the power sector |

| Hindustan Zinc | 78% of the zinc industry in India |

| Multi Commodity Exchange | 92% share in India’s commodities exchange sector |

| Indian Railway Catering and Tourism Corporation | 100% of Online Booking for Railways |

| Bharat Heavy Electricals Limited | Holding a 67% share in the power equipment sector |

| Hindustan Aeronautics Limited | Dominating 100% of defense manufacturing in India |

| Container Corporation of India | 68.52% share in cargo carrier services |

Monopolies with foreign parent Companies

Monopolies with a Parent company outside, take away around 25% of the profit as royalty to their parent company. These companies do not work for the shareholders, they work to enrich their parent company. The parent company earns royalties irrespective of whether the Indian subsidiary is making a profit or loss. It is better to buy the parent company rather than buying the Indian subsidiary because the valuation will be cheaper.

By buying the foreign entity you are indirectly buying the Indian company. The Royalty can be increased by the parent whenever it wants since the major shareholder is the parent company. Government has no say in this behavior, simply it will say to pay tax on the royalty. Bluntly put, if you are paying royalty give me some share as well in the form of tax.

| Company | Market Leader | Promotor Holding | Royalty | Monopoly in |

|---|---|---|---|---|

| Nestlé India | 96.5% share in the cereal industry | 62.76 | 5.25% of net sales nearly 25% of Profit | Holding an 82% share in coal production |

Monopolies in the Niche Segment

The overall Market of these products is very small. It is a Big Fish in a Small Pond. New companies will hesitate to enter into this small market. Since it is highly difficult to replicate the product it is not working when entering this market. These companies will stay in this business, but the growth is slow.

| Company | Market Leader | Brands/Industry |

|---|---|---|

| Alkyl Amines Chemicals Ltd. | A global leader in Ethyl amines | Used in the Pharma, Agri and Automobile Industry |

Monopolies in Discretionary Spending

When people have extra money to spend on Discretionary items. Want to paint a home that is discretionary in nature. This company will grow when the market is growing and employment is quite high. When the market is not so favorable, they will thrive through these times by reducing the margins. The competition will lose the market further and might end in bankruptcy

| Company | Market Leader | Brands/Industry |

|---|---|---|

| Pidilite Industries | 70% market share in the adhesive business | Fevicol, Dr. Fixit, Fevi-Kwik, M-Seal, Roff, Chemifix, Fevicryl, Araldite, Nina Percept,WD-40, HAI SHA, Feviseal, Tenax,Litokol, Jowat, Cidy |

| Asian Paints | 59% of the Paint Market | Asian Paints, Sleek, Berger, Weather Seal, Apco, Taubman, Kadisco, Scib |

| APL Apollo | Dominating 50% of the pre-galvanized and structural tube industry | Apollo structural , Apollo Z , & Apollo Galv |

| Oriental Carbon & Chemicals | 45% to 55% in Insoluble Sulphur | second preferred supplier to most global tyre makers |

Monopolies growing industry

A small portion of the industry is discovered, the market is likely to expand further into many folds. These companies will steadily grow as the market is growing. To give a perspective of the Size of growth for the Indian market. In the US one person out of 2 people invest in the stock market. In India 1 out of 5 people in India invest in the stock market. The Revenue of CAMS and CDSL is directly dependent on a number of people invested in the stock and how much they trade.The Growth Opportunity in the Huge.US Market is 10 times the Indian Market with 1/4th of the Population.

| India | US | |

|---|---|---|

| Total Net Assets | $4.1 Trillion | $47 Trillion |

| Households owned stocks | 17% | 58% |

| Population | 141 Crores | 33 Crores |

| Company | Market Leader | Brands/Industry |

|---|---|---|

| CAMS | 70% within the mutual fund industry | CAMS KRA, CAMS Pay, WealthServ 2.0, CAMS Rep |

| CDSL | 59% in depository business | CDSL facilitates holding and transacting securities in electronic form and facilitates the settlement of trades |

| Praj Industries | 60% in the ethanol plant installation industry | Petrol Blending |

| ITC | ITC has a 70% share in the cigarette business | Insignia, India Kings, Classic, Gold Flake, American Club, Wills Navy Cut, Players, Scissors, Capstan, Berkeley, Bristol, Flake, Silk Cut, Duke & Royal |

Praj Industries

Ethanol blending currently is 11%, where need to increase the blending to 20%. Every litre of petrol requires 20% Ethanol. The growth opportunity is huge

ITC

ITC has a 70% share in the cigarette business. In order for the new business to venture into this business, they need to create a cigarette that can be bought by people who haven’t used the brand earlier. For Example, if I am a Cigarette smoker, If I regularly smoke lite, why do I want to try a new brand that has come into the market recently? How will I know about the cigarette if it cannot be advertised? The Cigarette is sold in small pawn shops, why will the pawnshop owners buy into your cigarette

ITC over the years not knowing what to do with so much cash it gets from the business, it started giving cash as dividends, and some cash started investing in FMCG Business.

- Packaged foods: Aashirvaad, Sunfeast, Bingo, Yippee noodles, Candyman and mint-o

- Personal Care: Savlon, Fiama, Vivel and Superia

- Stationary: Classmate and Paperkraft

- Apparels: WLS

- Agarbattis: Mangaldeep and AIM (matches)

Monopolies in India, the threat from outside India

They are currently enjoying a monopoly in the Indian market but are likely to face competition from outside India.

| Company | Market Leader |

|---|---|

| IndiaMART | 60% market share of the online B2B classifieds space |

| Borosil Renewables Ltd | Sole producer of Solar glass in India |

Borosil Renewables Ltd

Borosil is the only company in India to Manufacture solar glasses. Directorate General of Trade Remedies has imposed anti-dumping duty for solar panels imported from countries like China and Vietnam up to 2026. The safety net cannot continue for long, it might face stiff competition when the anti-dumping duty is withdrawn.

IndiaMART

IndiaMART has been listed as a “notorious market” since 2018 by the USTR(Office of the United States Trade Representative) for selling counterfeit products and illegal pharmaceuticals.

The success of the company will depend upon how it can handle these issues.

Conclusion:

Finding and Investing in a Monopoly business has a new set of challenges. The valuation of Monopoly business always tends to be overvalued. Have I missed any Monopoly business and do you have any alternate opinion of the listed monopoly business