Why is the Nobel Prize given the name Nobel Prize? Who is sponsoring the Nobel Prize?

Nobel Prizes are given to personalities who have made significant contributions to humanity in the fields of physics, chemistry, physiology or medicine, literature, and peace for the previous year. This was the will of Alfred Nobel.

Little History of Alfred Nobel

Alfred Bernhard Nobel was born on 21st October 1833. He was a Swedish chemist, inventor, engineer, and businessman. He also made several important contributions to science, holding 355 patents in his lifetime. Alfred is best known for the invention of dynamite and an explosive device called a blasting cap. He passed away in 1895. His will consisted that all of his wealth be invested in safe assets and a portion of it given as cash for those who made significant contributions to physics, chemistry, physiology or medicine, literature, and peace. He left behind 31 million SEK of wealth for the Nobel prize believing that based on the seed money/ wealth, it would be able to provide such awards for 30 years. Even after 121 years, the Nobel Foundation can afford to continue its journey due to its investment fundamentals.

The Nobel Foundation

The Nobel Foundation was started in the year 1901. The prize money given for the first time was 150,000 SEK (which is equivalent to 1 million $ as of today’s value). From then the prize money fluctuated a bit based on the investment performance of Alfred Nobel’s investments. The prize money is approximately 0.3% – 0.4% of the value of the investment. According to the organization’s annual report, the intention is to generate 3.5 returns above inflation. They invest 55% in equity, 10% in fixed income, 10% in property, and 25% in alternate assets.

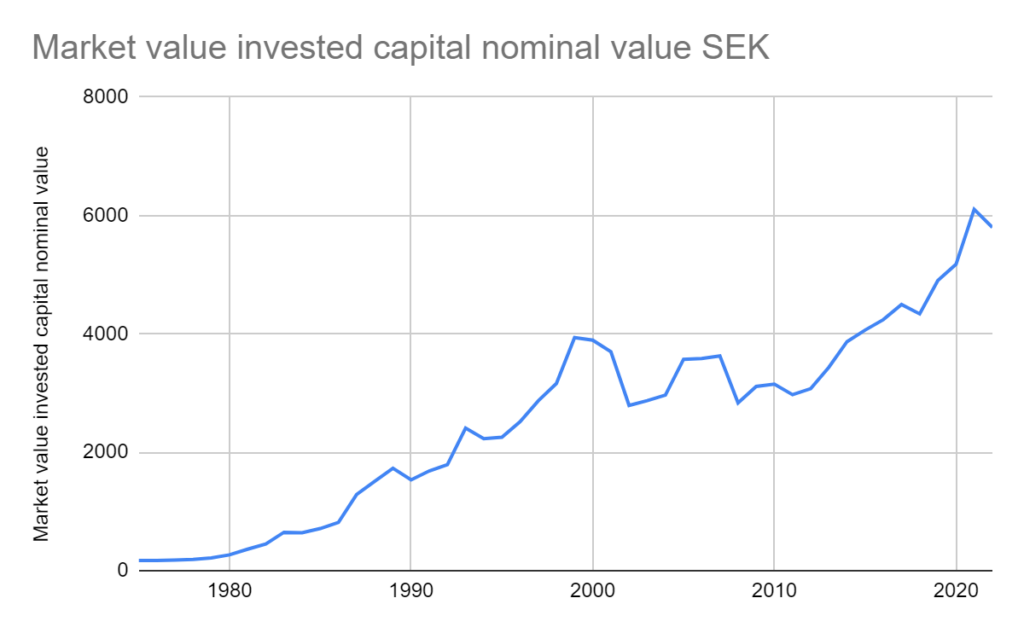

Performance of the Alfred Nobel Investments

The wealth of Alfred Nobel’s investment increased from 31 Million SEK to 5800 Million SEK after 121 years. A total of 320 Million SEK was taken from the investment for the payment of prize money. Approximately 0.3% – 0.4% of money is taken away from the wealth each year for the payment of prize money. Probably another 0.5% would have been taken away for the administrative expenses which include shortlisting of candidates, selection of the candidate, employee salaries and cost of hosting the award function.

The investment returns after taking away 1% of the amount from the investment every year the over the returns is around 4.4%

This is one of the best examples of how wealth management can be used for noble causes. This also stays as a standing principle for the importance of money management