Difference between Banks and NBFCs

Non-Banking Financial Company (NBFC) are similar to Banks but have fewer regulations. They work a lot like a Bank but they cannot take deposits from people. They can borrow from Banks or through Bonds.

Working Model of Banks and NBFCs

Banks take money as deposits and lend the money for Interest. They take the money with lower interest and lend the money with higher interest. The difference in the interest between borrowing and lending is their profit. Some portion of the money they lend never comes back. This portion of the loan is a non-performing asset to the bank, since the bank is not able to get the principal and interest for the loan provided. Hence the bank sets aside its portion of the profit as a provision to address this problem in case of permanent loss.

Types of Loans

Various reasons exist for borrowing loans, including buying a vehicle, personal loan and so on. Other category is of loans for Business purposes, MSME. Individuals take out retail loans and companies take out business loans. Retail loans are considered less risky because the lender secures the loan with collateral before granting it.

Vehicle Loan: Borrowers can take out these loans to purchase a new or used vehicle. The lending institution retains the right to repossess the vehicle if the loan is not repaid. Banks sell these vehicles through auction to recover the portion of the loan. The duration of the loan period is 1 to 7 years.

Gold Loan: Borrower provides gold as collateral to obtain gold loans. The duration of the gold loans is generally 1 year or 2 years. If the borrower cannot repay the loan, an auction is held to sell the gold and the money is recovered. Gold loans are generally safe. The entire amount of a gold loan is typically recovered by selling the gold. Gold has sentimental value in the Indian community; hence we would always want gold to be recovered.

Home loan: The duration of home loan is 15 to 25 years. The Home is taken as collateral for the loan. 80% of the value of the home is provided as a loan, hence in case of default, the banks can easily recover the money from the sale of the home. This situation is very rare. Home buyers will want to pay loans instead of defaulting on loans. The downside is very low and visibility of income is up to 15 to 25 years. There is steady income for the bank for a very long duration.

Current Account and Saving Account Ratio

Banks get the money as savings account deposits/current accounts which we keep in the bank. Other ways are through Fixed deposit and bond markets or central bank lending. The interest rates provided in the savings account and current account is in the range of 3% to 4%. It is cheap cash, hence it is always preferable for banks to take money through a Current account or savings account. CASA ratio is the ratio of deposits in current and savings account to total deposits of a Bank. This ratio determines how much percentage of borrowing of the bank is through low-cost funding/ through current accounts and saving accounts. The higher the value the better it is for the banks.

Net Interest Margin

The difference in the interest gained from loan to expense occurred due to interest payment of borrowed money (for example, deposits)

Net Interest Margin = (Interest Income – Interest Expense) / Total Assets

Provision Coverage Ratio

The bank sets aside a certain amount from the profits to cover up the Bad loans. The provision coverage ratio tells the percentage of loan defaults that are provisioned. Let us assume, the bank has a bad loan of Rs 100 Crore. If the bank sets aside Rs 75 crore for the bad loan, then the coverage ratio is 75%.

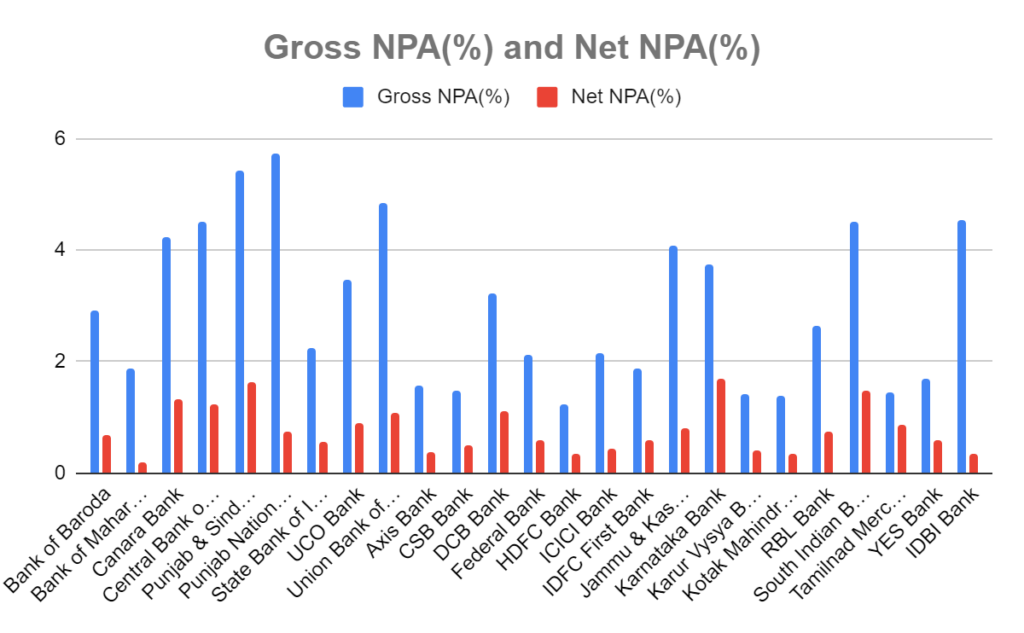

GNPA – Gross Non-Performing Assets

Gross NPA is the total value of non-performing assets of the bank. This is an absolute number and can tell you the amount of loans that the bank is not earning money on.

GNPA can also be expressed as a percentage of the total loans issued by the bank. This can tell you the percentage of the total loans that are currently non-recoverable.

Example: If a bank has issued a total of Rs.100 crore as loans and has a GNPA of Rs.5 crore, then the GNPA percentage will be 5%. In other words, five percent of the loans issued by the bank are currently non-recoverable.

Remember, a high GNPA means the bank has a poor quality of assets.

NNPA – Net Non-Performing Assets

As explained above, banks set aside funds for uncertain loans issued by them. By subtracting the NPA Provisioning amount from GNPA, the net impact of the non-performing assets can be determined. This is the Net NPA. NNPA can express itself as a percentage, similar to GNPA.

NNPA = GNPA – NPA Provisioning

Example: If a bank has issued a total of Rs.100 crore as loans, a GNPA of Rs.5 crore, and NPA Provisioning of Rs.2 crore, then the NNPA will be Rs.3 crore, and the NNPA percentage will be 3%.

Price to Book (P/B) Ratio

Shareholder equity generally represents the book value of a bank. If we subtract the borrowing of bank and loan lent, then it will be approximately equal to shareholder equity. Generally, Banks do have very small assets in machinery and buildings. If the book value of the Bank’s share is higher than the share price, it is considered an attractive investment.

Book Value = Total Assets – Total Liabilities

The price/Book value is 1 if the Current market price and Book value are the same. If the P/B is less than 1, then the current market price is less than the book value. The Valuation is attractive if the P/B value is less or equal to 1. If the P/B is much greater than 1, then the market is giving a premium valuation for the bank.

P/B Ratio = Market Price / Book Value

Capital Adequacy Ratio (CAR)

A high CAR indicates that the bank has enough capital to manage sudden losses. Banking regulators ensure that banks do not take on excess leverage and become insolvent (by enforcing the CAR).

Let us understand this ratio with an example in layman’s terms

Let’s say the bank XYZ has given 100 rupees of loan. In cases of times like Corona, wars or Earthquakes will result in a large number of losses. At this time the assumption is that 10% of the Money of the loan will not come back and it will be a loss to the bank. In such a situation the banks should have the Money equivalent to 10% i.e. Rs 10 in cash to manage such a situation.

Formula

Capital Adequacy Ratio = (Tier 1 Capital + Tier 2 Capital) / Risk weighted Assets

Tier 1 Capital + Tier 2 Capital is basically the cash available with the banks

Risk-weighted Assets are basically the loans lent by the banks

Basel Norms III (banking regulators) requires banks to keep 9% (In the Example round value 10% is considered for understanding purposes) CAR for the banks to be considered safe. One of the best ways to assess a bank’s potential to absorb losses is to look at its Capital Adequacy Ratio or CAR.

Liquidity Coverage Ratio

This tells if the banks have sufficient cash to run their operations for the next 30 days. The disadvantage of the Liquidity Coverage Ratio is, that the cash left with the bank does not produce any interest.

Liquidity Coverage Ratio = High-Quality Liquid Asset Amount / Total Net Cash Flow Amount

High-Quality Liquid Asset Amount is the cash available with banks

Total Net Cash Flow Amount – In/Out Transaction of cash in the bank.

Another way of seeing the Liquidity of the bank is through the Loan-to-Deposit Ratio. Banks provide this percentage of loans using the deposits they have received. If the value is 100%, then the bank has lent all the money it has received as deposits, there is no money left with the bank. In case the value is more than 100%, then banks did not have a sufficient amount to lend the loans, so they took additional loans from outside and re-loaned them at a higher interest. This situation is risky because, Bank did not have the money it wants to lend.

Loan-to-Deposit Ratio should not also be too low, taking the money as deposits and not lending it. They have to pay interest but in turn, they don’t get any interest.

Conclusion:

We had a fair idea of understanding the ratios of banking and NBFC. Banks and NBFC play important role in the economy and growth of the country. Generally, they will grow as the market grows. If the country is growing at 8%, it can also grow at that rate. If we want steady growth, the banking sector is one area we should consider in investing. the downside is they can’t grow as fast as the hot industry. Regulators will put a break on such cases due to associated risks.

Do you want to analyze the best Banking stocks which is the Reasonable Valuation? Comment Below and let me know what you think about whether this post is Useful or not.