Introduction

We stayed in a residential area. In our area there was a pond. Birds used to fly over nearby trees. Ducks, Swans used to reside over there. It is not a lake anymore now. The pond receives drainage water from the nearby houses and gradually turns into sewage. This is pathetic not only for the pond nearby our area but this is almost the same situation in many places all over India. Many freshwater ponds are being converted into drainage due to the lack of policy or implementation mechanisms.

The underground water table is reducing. The ground water level in the cities even at 1100ft is getting dried out.

Water Demand

Usable water is already a commodity. This problem will get worse in the years to come. There will be a need to treat effluent water from industries, and residential apartments. We need to treat the polluted water for reuse.

With this in mind, two companies that play a key role in large-scale purification production and solutions will be discussed here. The first company VA Tech Wabag will be discussed in this post. The other company is ION Exchange (which we will discuss in the next post)

The report by Niti Aayog expects the water demand to grow twice the available water supply.

According to Frost & Sullivan’s report, the Indian water and wastewater treatment market will likely reach $2.08 billion (17,341 Crores) by 2025 from $1.31 billion (10,921 Crores) in 2020. This means growth at a compound annual growth rate (CAGR) of 9 percent. The report also ranked India as the sixth largest market for environmental technologies in the world.

Challenges we face in water treatment

- Aging infrastructures

- Population growth and urbanization

- Emerging contaminants

- Climate Change

- Energy consumption and sustainability

Worldwide initiatives

- The Government of Saudi Arabia allocated $28 Billion for recycling 30% of its water by 2030

- Egypt is setting up 21 projects with renewable resources with 3 Billion dollars

- Investment in Europe for Capex and Opex of $4 Billion by 2040

VA Tech Wabag:

History of the Company

Its principal activities include the design, supply, installation, construction, and operational management of drinking water, wastewater treatment, industrial water treatment, and desalination plants.

It is a 100-year-old company that takes projects in EPC and O&M. The margin in EPC projects is 12% and the margin in O&M is 15%. They have 18% O&M projects and 82% EPC projects (Engineering, procurement and construction). They will want to improve the ratio to 25% O&M and 75% EPC, thereby increasing the average margin. They do have 12000 crores on the pipeline. On an average, the execution of a project takes 3 years. The company is expected to grow by 10-15%.

R&D Capabilities

The company owns 125+ IP rights and is technology-focused. It has R&D centers located in India and Europe

Key Projects FY23

a) Joint venture secured DBO order of seawater desalination project with a capacity of 400 MLD, worth ~Rs. 4,400 Crore, funded by JICA

b) Forayed into Bangladesh with a World Bank and AIIB-funded DBO order worth ~Rs. 800 Crore

c) Signed concession agreement for 40 MLD Recycle and Reuse TTRO plant in Ghaziabad

d) Secured a repeat order worth INR 430 Crore from Reliance Industries Limited for a 53 MLD Desalination plant at Jamnagar

e) Expanded Global footprint with a new JICA funded, consortium order for a 50 MLD desalination project in Senegal, worth EUR 146 Million

f) Secured industrial wastewater treatment order in Romania worth ~Rs. 260 Crore (EUR 30 Million).

Global Water Intelligence London ranks Wabag third globally for ensuring state-of-the-art drinking and clean water solutions.

What is the Growth rate?

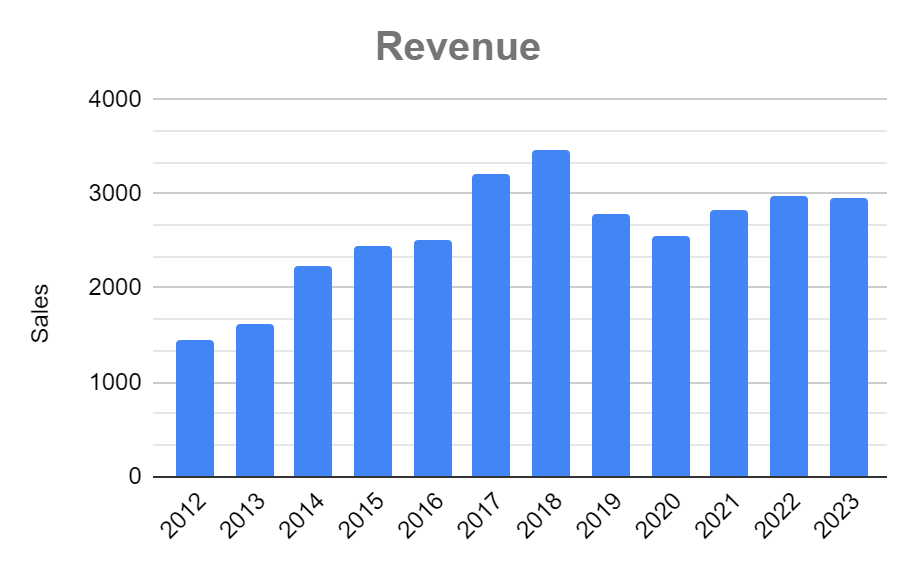

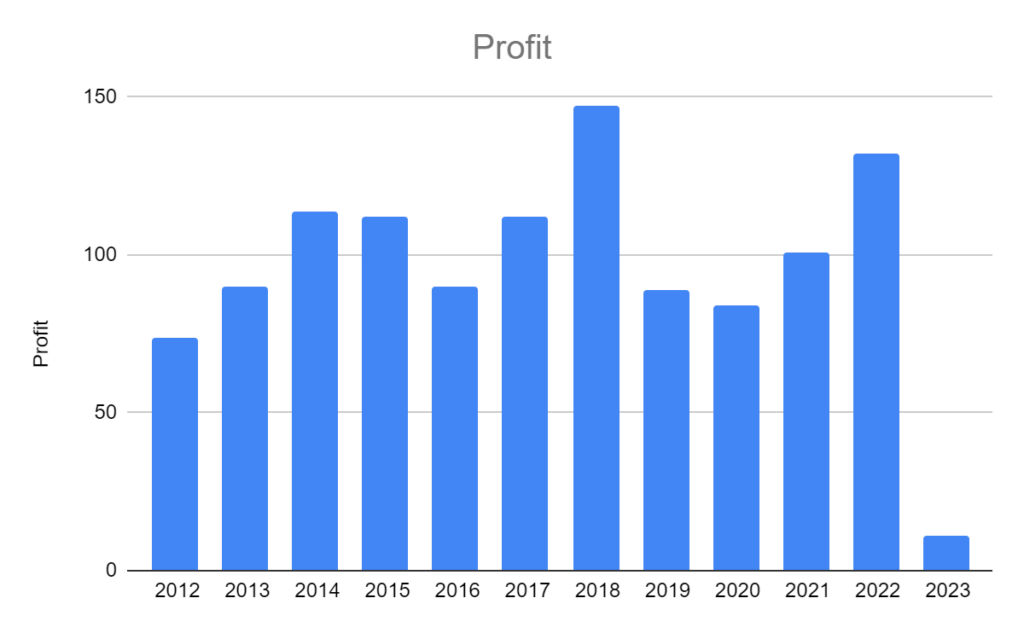

Revenue of 6.74% and Profit Growth Rate of 5.96%

The number shown in the profit and numbers that arise from the generation of bills raised for the completion of work. The Cash Flow represents the actual amount collected from the profit generated.

The company is unable to collect the amount after raising the bill to its customers. The customers of VA Tech Wabag are mostly Government, Municipalities and it is natural for any company to get money from the government. Let’s see how the Cash conversion is for the company.

Cash Conversion Cycle

What is the conversion cycle? How many days does it take a company to convert the cash it spends on inventory back into cash by selling its product? The Company takes around 186 days to collect the money after it has delivered the product. The company is aware of this problem.

VA Tech Wabag works on two models

- BOOT (build-own-operate-transfer)/ EPC (Engineering procurement and construction)

The duration of each project takes 2-3 years, and the cost of completion of the project needs to be borne by the company, hence financially stressful.

- O&M

The company takes up orders to operate and maintain the facility for a certain duration until the facility stabilizes after the construction of the project. Due to its expertise in the water industry, it can easily take on the project and generate revenue continuously.

The composition of BOOT/EPC is 87.6% and O&M is 12.4%. The company intends to increase the percentage of O&M to 25% so that it is comfortable enough to maintain a steady cash flow. We can notice from the trend line of cash flow, that the cashflow duration has reduced from 276 to 186 days. It aims to increase O&M to 25% and improve EBITDA margins.

Future Prospects

- Order book stands at around INR12,000 crores with a healthy mix of EPC and O&M

- Focus on green hydrogen, semiconductors, and bio-CNG plants